The Qualified Dividends And Capital Gains Tax Worksheet

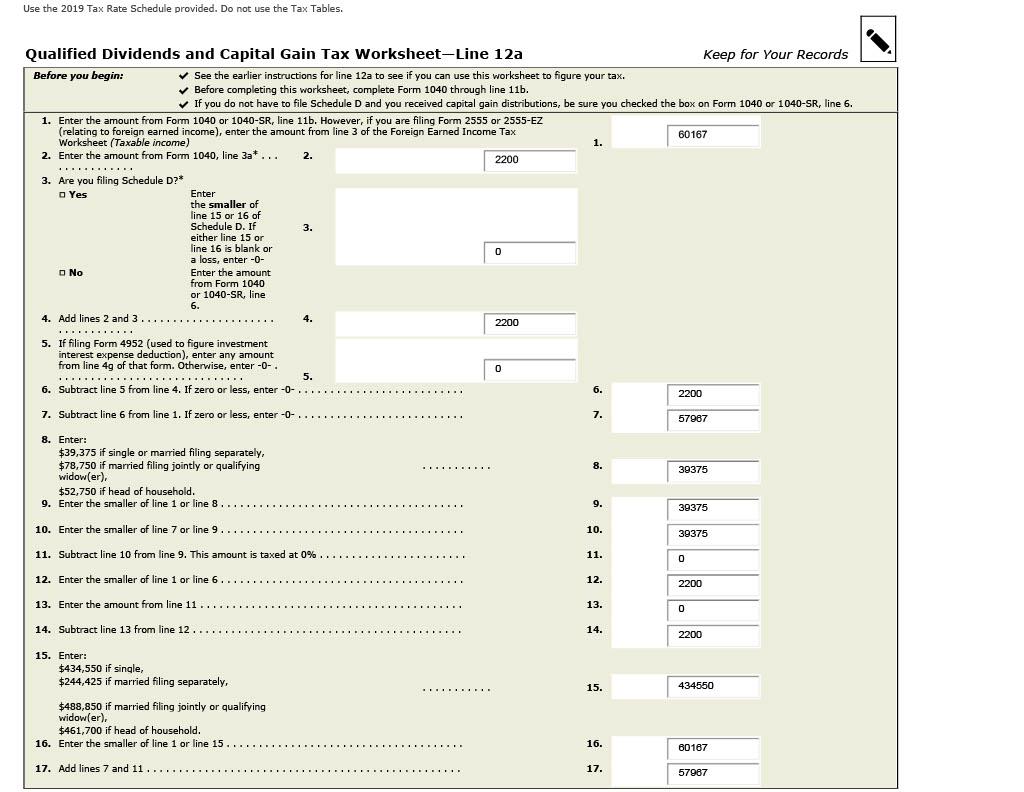

The Qualified Dividends And Capital Gains Tax Worksheet - Before completing this worksheet, complete form 1040 through line 15. Web how do i generate the worldwide qualified dividends and capital gains worksheet on line 18 for form 1116 in a 1040 return using cch axcess™ tax or cch® prosystem fx® tax? The 25 lines are so simplified, they end up. Before completing this worksheet, complete form 1040 through line 11b. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains worksheet in 2003. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. Web the qualified dividends and capital gain tax worksheet is a form used to calculate taxes on qualified dividends and capital gains. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations ( form 1040 instructions (2013), p. See the instructions for line 16 for details.

It helps taxpayers accurately calculate their taxes by taking into account the different tax rates for both qualified dividends and capital gains. Ordinary income is then everything leftover, which is taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet: See the instructions for line 16 for details. Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains worksheet in 2003. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d.

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. Web the qualified dividends and capital gain tax worksheet is a form used to calculate taxes on qualified dividends and capital gains. Ordinary income is then everything leftover, which is taxable income minus qualified income. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line.

Capital Gains Tax Worksheet Nidecmege

In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. Web how do i generate the worldwide qualified dividends and capital gains worksheet on line 18 for form 1116 in a 1040 return using cch axcess™ tax or cch® prosystem fx® tax? Web qualified dividends and capital.

Qualified Dividends And Capital Gain Tax Worksheet —

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. See the instructions for line 16 for details. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the.

31 Qualified Dividends And Capital Gain Tax Worksheet Line 44 support

It helps taxpayers accurately calculate their taxes by taking into account the different tax rates for both qualified dividends and capital gains. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains worksheet in 2003. Ordinary income is then everything leftover,.

2015 Qualified Dividends And Capital Gain Tax Worksheet 1040a Tax Walls

It helps taxpayers accurately calculate their taxes by taking into account the different tax rates for both qualified dividends and capital gains. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d. Web how is the qualified dividends and capital gain tax worksheet used? Web use.

Qualified Dividends And Capital Gains Worksheet 2018 —

Ordinary income is then everything leftover, which is taxable income minus qualified income. See the instructions for line 16 for details. The 25 lines are so simplified, they end up. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d. Web irs introduced the qualified dividend.

Qualified Dividends And Capital Gain Tax Worksheet 2019 worksheet today

Ordinary dividends are going to be treated as ordinary income. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web qualified dividends.

Create a Function for calculating the Tax Due for

Ordinary dividends are going to be treated as ordinary income. Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends. Before completing this worksheet, complete form 1040 through line 15. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations (.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

Ordinary income is then everything leftover, which is taxable income minus qualified income. Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends. Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the.

Solved Please help me with this 2019 tax return. All

Ordinary dividends are going to be treated as ordinary income. In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations ( form 1040 instructions (2013), p. Web.

The Qualified Dividends And Capital Gains Tax Worksheet - Before completing this worksheet, complete form 1040 through line 11b. Ordinary dividends are going to be treated as ordinary income. With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Ordinary income is then everything leftover, which is taxable income minus qualified income. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends.

Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Web qualified dividends and capital gain tax worksheet (2020) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains worksheet in 2003.

In order to use the qualified dividends and capital gain tax worksheet, you will need to separate your ordinary dividends from qualified dividends. Before completing this worksheet, complete form 1040 through line 15. Ordinary income is then everything leftover, which is taxable income minus qualified income. Web how do i generate the worldwide qualified dividends and capital gains worksheet on line 18 for form 1116 in a 1040 return using cch axcess™ tax or cch® prosystem fx® tax?

Web How Is The Qualified Dividends And Capital Gain Tax Worksheet Used?

Before completing this worksheet, complete form 1040 through line 15. Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends. Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d.

Web Irs Introduced The Qualified Dividend And Capital Gain Tax Worksheet As An Alternative To Schedule D And Added The Qualified Dividends And New Rates To The Capital Gains Worksheet In 2003.

Before completing this worksheet, complete form 1040 through line 11b. See the instructions for line 16 for details. Ordinary income is then everything leftover, which is taxable income minus qualified income. Web it takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations ( form 1040 instructions (2013), p.

Web Qualified Dividends And Capital Gain Tax Worksheet (2020) See Form 1040 Instructions For Line 16 To See If The Taxpayer Can Use This Worksheet To Compute The Taxpayer’s Tax.

Web qualified dividends and capital gain tax worksheet (2022) see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Ordinary dividends are going to be treated as ordinary income. The 25 lines are so simplified, they end up.

See The Earlier Instructions For Line 11A To See If You Can Use This Worksheet To Figure Your Tax.

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: Web how do i generate the worldwide qualified dividends and capital gains worksheet on line 18 for form 1116 in a 1040 return using cch axcess™ tax or cch® prosystem fx® tax? Complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even if you don’t need to file schedule d. With a good understanding of the mechanics, preparers can spot opportunities to advise clients to take advantage of the 0% rate and minimize the 20% rate.