Qualified Dividends Worksheet 2022

Qualified Dividends Worksheet 2022 - A qualified dividend is a type of dividend to which capital gains tax rates are applied. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web in the united states, a dividend eligible for capital gains tax rather than income tax. Web qualified dividends and capital gain tax worksheet. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. The 0% and 15% rates. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Knowing how to download this form from the. 23 replies by anura guruge on february 24, 2022. (step by step) tax regardless of country and continent, all individuals.

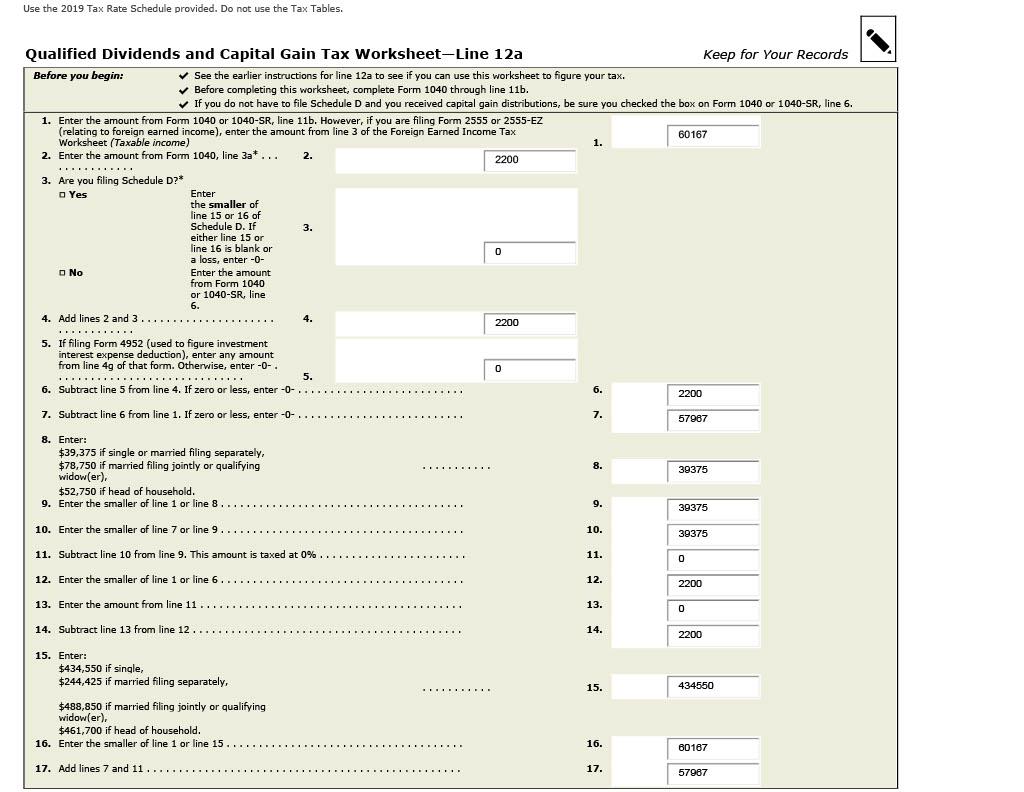

23 replies by anura guruge on february 24, 2022. Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns. A qualified dividend is a type of dividend to which capital gains tax rates are applied. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. Knowing how to download this form from the. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. This is advantageous to the investor as capital gains are usually taxed at a lower rate than.

Web qualified dividends and capital gain tax worksheet. Web 2022 qualified dividend income rates summary worksheet. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web in the united states, a dividend eligible for capital gains tax rather than income tax.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. These tax rates are usually lower than regular income. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. Show details how it works upload the. A qualified.

Qualified Dividends and Capital Gain Tax Worksheet 2019 Capital gains

Web 2022 qualified dividend income rates summary worksheet. These tax rates are usually lower than regular income. Show details how it works upload the. Web schedule d (form 1041) and schedule d tax worksheet. (step by step) tax regardless of country and continent, all individuals.

Qualified Dividends And Capital Gain Tax Worksheet 2016

Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. Web capital gains and qualified dividends. Qualified dividends are also included in the ordinary dividend total required to.

2022 Qualified Dividends And Capital Gains Worksheet

Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. 23.

Qualified Dividends and Capital Gain Tax Worksheet—Line 44

Worksheets are qualified dividends and capital gain tax work 2020, 40 of 117, qualified dividends cap gains,. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. Web.

2022 Qualified Dividends And Capital Gain Tax Worksheet

Web qualified dividends and capital gain tax worksheet. For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Web ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. 23 replies by anura guruge on february 24, 2022. Web 2022 qualified.

2015 2020 Form IRS Instruction 1040 Line 44 Fill Online 1040 Form

Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns. Web in the united states, a dividend eligible for capital gains tax rather than income tax. Enter your total qualified dividends on line 3a. 23 replies by anura guruge on february 24, 2022. Knowing how to download this form from the.

Irs Capital Gains Worksheet Form Fill Out and Sign Printable PDF

For tax year 2022, the 20% maximum capital gain rate applies to estates and trusts with income above $13,700. Leave a reply by anura guruge on. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. The 0% and 15% rates. Web 2022 qualified dividend income rates summary worksheet.

62 Final Project TwoQualified Dividends and Capital Gain Tax

Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. Worksheets are qualified dividends and capital gain tax work 2020, 40 of 117, qualified dividends cap gains,. Show details how it works upload the. For tax year 2022, the 20% maximum capital gain rate applies to estates.

Qualified Dividends Worksheet 2022 - The 0% and 15% rates. A qualified dividend is a type of dividend to which capital gains tax rates are applied. Enter your total qualified dividends on line 3a. This is advantageous to the investor as capital gains are usually taxed at a lower rate than. Web 2022 qualified dividend income rates summary worksheet. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. Web capital gains and qualified dividends. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Web qualified dividends and capital gain tax worksheet. Web schedule d (form 1041) and schedule d tax worksheet.

Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. A qualified dividend is a type of dividend to which capital gains tax rates are applied. Knowing how to download this form from the. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. Web qualified dividends and capital gain tax worksheet.

Enter your total qualified dividends on line 3a. Web 2022 qualified dividend income rates summary worksheet. A qualified dividend is a type of dividend to which capital gains tax rates are applied. This is advantageous to the investor as capital gains are usually taxed at a lower rate than.

(Step By Step) Tax Regardless Of Country And Continent, All Individuals.

This is advantageous to the investor as capital gains are usually taxed at a lower rate than. These tax rates are usually lower than regular income. The 0% and 15% rates. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math.

Web Schedule D (Form 1041) And Schedule D Tax Worksheet.

Enter your total qualified dividends on line 3a. Leave a reply by anura guruge on. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. Show details how it works upload the.

Web Capital Gains And Qualified Dividends.

A qualified dividend is a type of dividend to which capital gains tax rates are applied. Qualified dividends are also included in the ordinary dividend total required to be shown on line 3b. Worksheets are qualified dividends and capital gain tax work 2020, 40 of 117, qualified dividends cap gains,. Knowing how to download this form from the.

Web Qualified Dividends And Capital Gain Tax Worksheet.

Web in the united states, a dividend eligible for capital gains tax rather than income tax. Web instructions for form 8615 (2022) tax for certain children who have unearned income section references are to the internal revenue code unless otherwise noted. 23 replies by anura guruge on february 24, 2022. Web 2022 qualified dividend income rates summary worksheet.