Qualified Dividends Tax Worksheet 2022

Qualified Dividends Tax Worksheet 2022 - Schedule d (form 1041) and schedule d tax worksheet. Web fill qualified dividends and capital gain tax worksheet 2022 pdf, edit online. Web 46) compute the tax on the amount on line 1. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. (step by step) tax regardless of country and continent, all individuals. Web one item that all taxpayers must complete is the qualified dividends and capital gain tax worksheet. • $41,676 to $459,750 for single filers. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin:

Show details how it works upload the. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. • $41,676 to $459,750 for single filers. Web qualified dividends and capital gain tax worksheet. Web 2022 tax rate schedule. • $41,676 to $258,600 for married filing separately. Web fill qualified dividends and capital gain tax worksheet 2022 pdf, edit online.

23 replies by anura guruge on february 24, 2022. Web qualified dividends and capital gain tax worksheet. Show details how it works upload the. See the earlier instructions for line 11a to see if you can use this. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

2022 Qualified Dividends And Capital Gains Worksheet

23 replies by anura guruge on february 24, 2022. If the amount on line 1 is $100,000 or more, use. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. Web 2022 tax rate schedule. Web the qualified dividend tax rate rises to 15% for the next tax brackets:

Qualified Dividends And Capital Gain Tax Worksheet —

Web this is an excel spreadsheet to help aid in your calculations for the 2022 qualified dividends and capital gains worksheet. See the earlier instructions for line 11a to see if you can use this. Web the qualified dividend tax rate rises to 15% for the next tax brackets: Web if there is an amount on line 18 (from the.

2017 Qualified Dividends And Capital Gain Tax Worksheet —

Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. Show details how it works upload the. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. 23 replies by anura guruge on february 24,.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

See the earlier instructions for line 11a to see if you can use this. Web one item that all taxpayers must complete is the qualified dividends and capital gain tax worksheet. If the amount on line 1 is $100,000 or more, use. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero.

Qualified Dividends And Capital Gains Worksheet 2010 —

See the earlier instructions for line 11a to see if you can use this. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on. Web this is an excel spreadsheet.

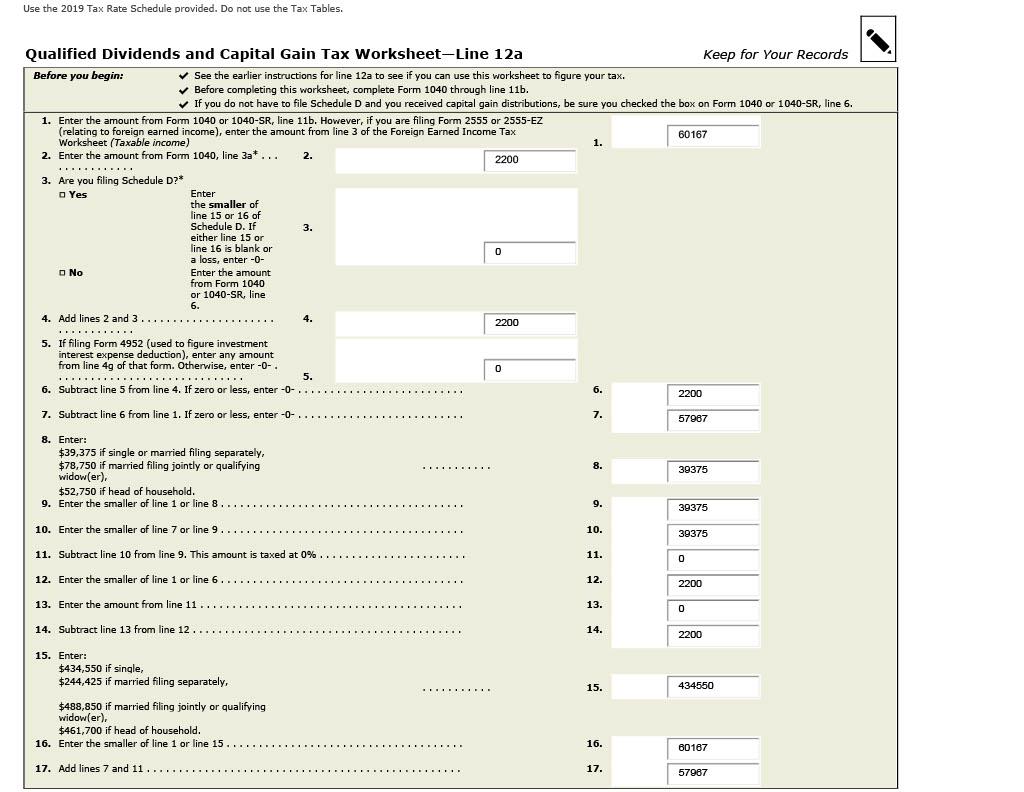

Solved Please help me with this 2019 tax return. All

Schedule d (form 1041) and schedule d tax worksheet. See the instructions for line 16 for details. • $41,676 to $258,600 for married filing separately. 23 replies by anura guruge on february 24, 2022. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly.

Qualified Dividends and Capital Gain Tax Worksheet 2019

Web this is an excel spreadsheet to help aid in your calculations for the 2022 qualified dividends and capital gains worksheet. Web ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math. Sign, fax and printable from pc, ipad, tablet or mobile with pdffiller instantly. If the amount on line.

Online Fillable Form For Qualified Dividend Printable Forms Free Online

This worksheet allows taxpayers to accurately report their. Web 2022 tax rate schedule. • $41,676 to $258,600 for married filing separately. Web 46) compute the tax on the amount on line 1. Web one item that all taxpayers must complete is the qualified dividends and capital gain tax worksheet.

2011 Form IRS Instruction 1040 Line 44 Fill Online, Printable, Fillable

(step by step) tax regardless of country and continent, all individuals. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d. Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of.

Qualified Dividends Tax Worksheet 2022 - Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. If the amount on line 1 is less than $100,000, use the tax table to compute the tax. Web fill qualified dividends and capital gain tax worksheet 2022 pdf, edit online. Web 46) compute the tax on the amount on line 1. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. Web qualified dividends and capital gain tax worksheet. See the instructions for line 16 for details. 23 replies by anura guruge on february 24, 2022. • $41,676 to $459,750 for single filers. Schedule d (form 1041) and schedule d tax worksheet.

Web the qualified dividend tax rate rises to 15% for the next tax brackets: 23 replies by anura guruge on february 24, 2022. If the amount on line 1 is $100,000 or more, use. Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. Web ‘qualified dividends and capital gain tax worksheet’ for tax year 2022 — a basic, simple excel spreadsheet for the math.

Show details how it works upload the. This is to be used in conjunction. This printable pdf blank is a. This worksheet allows taxpayers to accurately report their.

If The Amount On Line 1 Is Less Than $100,000, Use The Tax Table To Compute The Tax.

Web if there is an amount on line 18 (from the 28% rate gain worksheet) or line 19 (from the unrecaptured section 1250 gain worksheet) of schedule d (form 1040) capital gains. • $41,676 to $459,750 for single filers. Web 46) compute the tax on the amount on line 1. Show details how it works upload the.

Web How Your Tax Is Calculated:

See the instructions for line 16 for details. Web if the estate or trust received qualified dividends or capital gains as income in respect of a decedent and a section 691(c) deduction was claimed, you must reduce the amount on. • $41,676 to $258,600 for married filing separately. This is to be used in conjunction.

Web One Item That All Taxpayers Must Complete Is The Qualified Dividends And Capital Gain Tax Worksheet.

Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. (step by step) tax regardless of country and continent, all individuals. Web the qualified dividend tax rate rises to 15% for the next tax brackets: Schedule d (form 1041) and schedule d tax worksheet.

Sign, Fax And Printable From Pc, Ipad, Tablet Or Mobile With Pdffiller Instantly.

See the earlier instructions for line 11a to see if you can use this. Web 2022 alternative minimum tax—individuals department of the treasury internal revenue service go to www.irs.gov/form6251 for instructions and the latest information. If the amount on line 1 is $100,000 or more, use. Web fill qualified dividends and capital gain tax worksheet 2022 pdf, edit online.