Qualified Dividends And Capital Gain Tax Worksheet

Qualified Dividends And Capital Gain Tax Worksheet - Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d tax worksheet and if any of the following applies. Before completing this worksheet, complete form 1040 through line 10. Web the complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Complete lines 21 and 22 below. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. These tax rates are lower than the income tax rate on ordinary or unqualified dividends. Before completing this worksheet, complete form 1040 through line 11b.

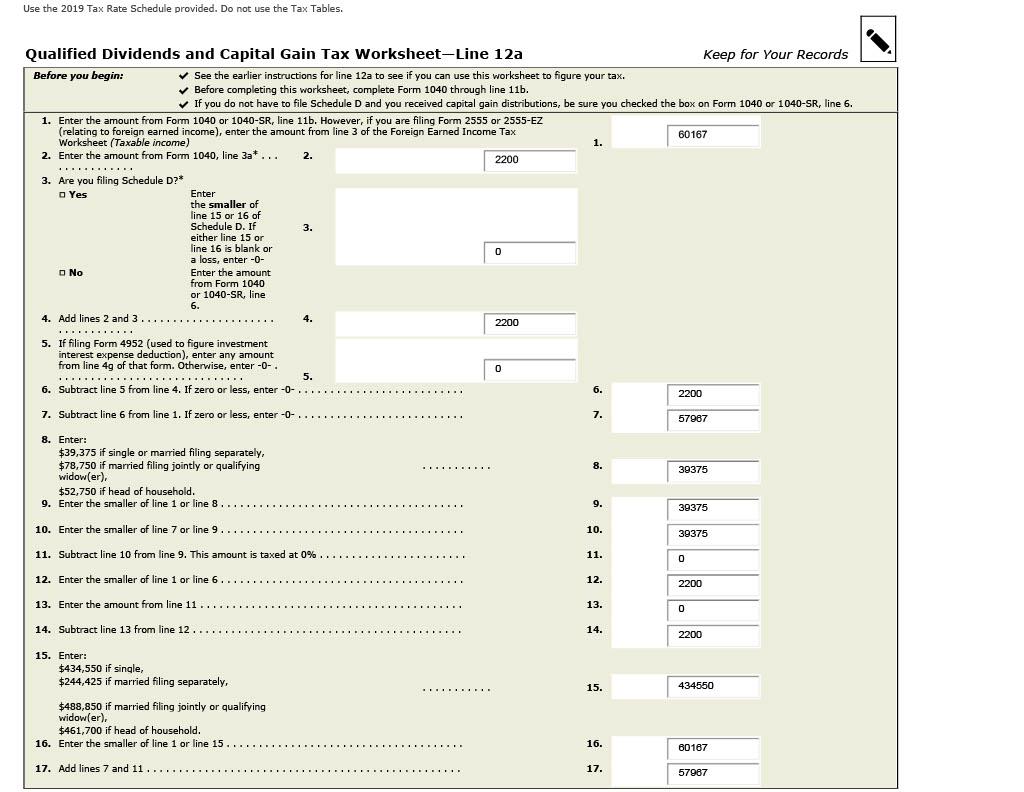

• before completing this worksheet, complete form 1040 through line 15. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. With a good understanding of the mechanics, preparers can spot opportunities to advise clients to. Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Before completing this worksheet, complete form 1040 through line 11b. Complete lines 21 and 22 below. Web figure the tax using the tax table, tax computation worksheet, qualified dividends and capital gain tax worksheet, schedule d tax worksheet, or schedule j, whichever applies.

Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. If line 14 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. Web qualified dividends and capital gain tax worksheet—line 11a. Before completing this worksheet, complete form 1040 through line 10. Web irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains worksheet in 2003.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. It takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations (form 1040 instructions (2013), p. Before completing this worksheet, complete form 1040 through line 11b. If the taxpayer.

Qualified Dividends And Capital Gain Tax Worksheet 2016 —

If line 14 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? You reported qualified dividends on form 1040, line 3a. Web use the qualified dividends and capital gain tax worksheet or.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages. Web a qualified dividend is described as a dividend from stocks or shares taxed on capital gain tax rates. Before completing this worksheet,.

Qualified Dividends And Capital Gain Tax Worksheet —

If line 14 includes any net capital gain or qualified dividends, use the qualified dividends and capital gain tax worksheet to figure this tax. The tax rate on your capital gains and dividends will depend on your income. Start by indicating the portion of your gross income that the irs considers subject to taxes. Web the complexity comes from the.

31 Qualified Dividends And Capital Gain Tax Worksheet Line 44 support

Web use the qualified dividends and capital gain tax worksheet or the schedule d tax worksheet, whichever applies, to figure your tax. Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. You reported qualified dividends on form 1040, line 3a. Start by indicating the portion of your gross income that the irs.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

With a good understanding of the mechanics, preparers can spot opportunities to advise clients to. Web for 2003, the irs added qualified dividends and the new rates to the worksheet so that millions of taxpayers will still be able to get their full tax benefits without the schedule d. Web figure the tax using the tax table, tax computation worksheet,.

Qualified Dividends And Capital Gain Tax Worksheet 1040A —

The tax rate on your capital gains and dividends will depend on your income. What is the qualified dividend and capital gain tax worksheet? Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Figuring out the tax on your qualified dividends can be difficult for even the most experienced accountant. These tax rates.

Qualified Dividends And Capital Gain Tax Worksheet 2017 —

What is the qualified dividend and capital gain tax worksheet? These tax rates are lower than the income tax rate on ordinary or unqualified dividends. If “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. Web qualified dividends and capital gain tax worksheet. Web taxes are taken out switch both capital winner.

Solved Please help me with this 2019 tax return. All

Otherwise, complete the qualified dividends and capital gain tax worksheet in the instructions for form 1040, line. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Web qualified dividends and capital gain tax worksheet (2019) see form 1040.

Qualified Dividends And Capital Gain Tax Worksheet - Before completing this worksheet, complete form 1040 through line 15. Web qualified dividends and capital gain tax worksheet—line 11a. The tax rate on your capital gains and dividends will depend on your income. The 25 lines are so simplified, they end up. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d tax worksheet and if any of the following applies. Start by indicating the portion of your gross income that the irs considers subject to taxes. Prior to completing this file, make sure you fill out form 1040. • before completing this worksheet, complete form 1040 through line 15. Web in order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. What is the qualified dividend and capital gain tax worksheet?

The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages. Web figure the tax using the tax table, tax computation worksheet, qualified dividends and capital gain tax worksheet, schedule d tax worksheet, or schedule j, whichever applies. Complete lines 21 and 22 below. Complete lines 21 and 22 below. Web did you dispose of any investment(s) in a qualified opportunity fund during the tax year?

Web qualified dividends and capital gain tax worksheet (2019) see form 1040 instructions for line 12a to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. The tax rates on ordinary dividends are the same as the tax rates on income from salary or wages. Use the qualified dividends and capital gain tax worksheet to figure your tax, if you do not have to use the schedule d tax worksheet and if any of the following applies. Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax.

• Before Completing This Worksheet, Complete Form 1040 Through Line 15.

Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. Before completing this worksheet, complete form 1040 through line 15. See the instructions for line 16 for details. Web qualified dividends and capital gain tax worksheet—line 11a.

The Tax Rate On Your Capital Gains And Dividends Will Depend On Your Income.

With a good understanding of the mechanics, preparers can spot opportunities to advise clients to. What is the qualified dividend and capital gain tax worksheet? If “yes,” attach form 8949 and see its instructions for additional requirements for reporting your gain or loss. The 25 lines are so simplified, they end up.

By Understanding How The Worksheet Works And Taking Full Advantage Of The Available Credits And Deductions, Taxpayers Can Confidently Navigate Their Way Through.

It takes 27 lines in the irs qualified dividends and capital gain tax worksheet to work through the computations (form 1040 instructions (2013), p. Start by indicating the portion of your gross income that the irs considers subject to taxes. Web qualified dividends and capital gain tax worksheet: In order to figure out how to charge this tax, it’s best to use the qualified dividend or capitalize net tax worksheet.

Prior To Completing This File, Make Sure You Fill Out Form 1040.

You reported qualified dividends on form 1040, line 3a. Figuring out the tax on your qualified dividends can be difficult for even the most experienced accountant. The forms 1040 and 1040a, therefore, help investors to take advantage of lower capital gains rates without having to fill out the schedule d. Web figure the tax using the tax table, tax computation worksheet, qualified dividends and capital gain tax worksheet, schedule d tax worksheet, or schedule j, whichever applies.