Qualified Dividends And Capital Gain Tax Worksheet For 2021

Qualified Dividends And Capital Gain Tax Worksheet For 2021 - Enter the smaller of line 15 or 16 of schedule d. 1 2 enter adjustments and preferences treated as exclusion items (see instructions). This powerful paperwork editor will mitigate the hassle of the end of the taxation year. Knowing how to download this form from the irs website can save precious time during tax season. Click image to download clean, very simple excel. In order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. I calculated tax using qualified dividends and capital gain tax worksheet how will irs know that tax calculation is from qualified dividends and capital gain tax worksheet should i write it next to 1040 line 16? Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Although many investors use schedule d to get the benefit of lower capital gains tax rates others can still use a worksheet in the tax instructions to skip.

With dochub, you can easily complete your qualified dividends and capital gain tax worksheet 2021 for 2023. There are three tax rates—0%, 15% and 20%—and they apply at different taxable income levels depending on your. Estates and trusts, see instructions. Are you filing schedule d? This powerful paperwork editor will mitigate the hassle of the end of the taxation year. Web determine the amount of qualified dividends and capital gain distributions that are taxable by subtracting any capital losses from your total qualified dividends and capital gain distributions. Complete all necessary pages of form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

With dochub, you can easily complete your qualified dividends and capital gain tax worksheet 2021 for 2023. Ordinary income is everything else or taxable income minus qualified income. In order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Click image to download clean, very simple excel.

ACC 330 61 Final Project Practice Tax Return Qualified Dividends and

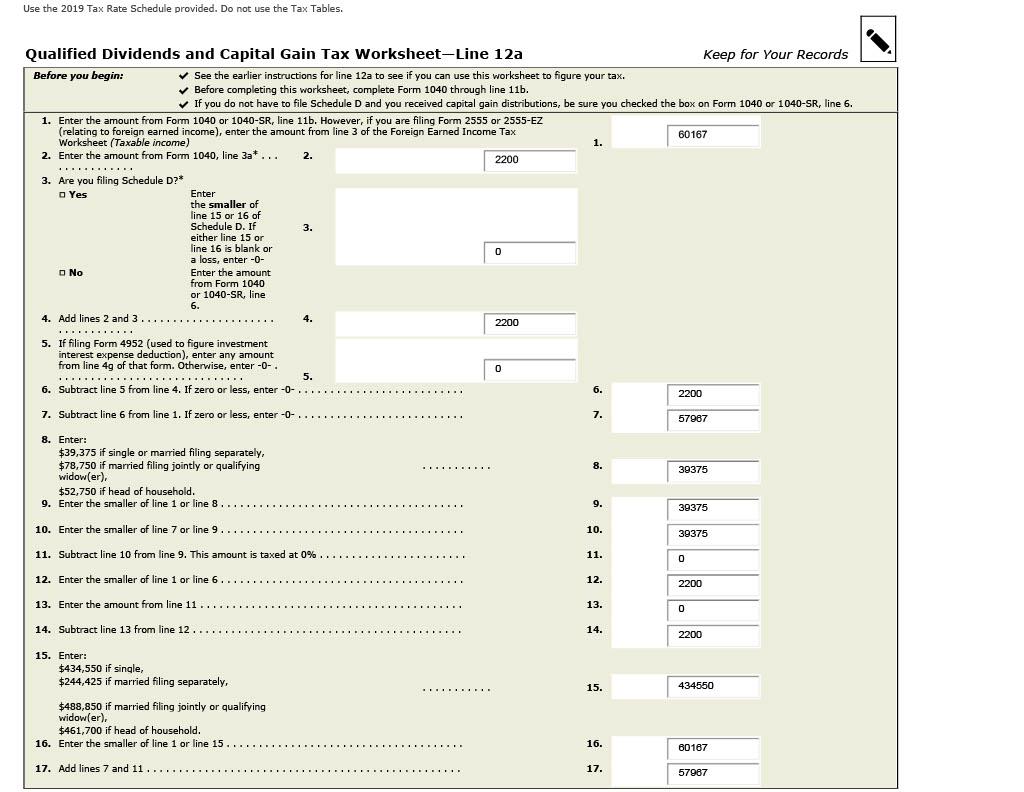

Web qualified dividends and capital gain tax worksheet—line 12a keep for your records. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: I calculated tax using qualified dividends and capital gain tax worksheet how will irs know that tax calculation is from qualified dividends and capital gain tax worksheet should i write it.

39 capital gain worksheet 2015 Worksheet Master

Web this way, a small error will not cost a printed blank, and you can fix everything before sending. • before completing this worksheet, complete form 1040 through line 15. What is the qualified dividend and capital gain tax worksheet? Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. In order to.

Qualified Dividends And Capital Gain Tax Worksheet —

Estates and trusts, see instructions. Web 2021 attachment 801 name(s) shown on return identifying number part i net minimum tax on exclusion items 1 combine lines 1 and 2e of your 2020 form 6251. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d.

2016 Schedule C Tax Form Lovely Qualified Dividends And —

Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Otherwise, complete the qualified dividends and.

Amt Qualified Dividends And Capital Gains Worksheet Ivuyteq

What is the qualified dividend and capital gain tax worksheet? See the instructions for form 8949. Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Click image to download clean, very simple.

Qualified Dividends And Capital Gain Tax Worksheet —

Web qualified dividends and capital gain tax worksheet: Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. With dochub, you can easily complete your qualified dividends and capital gain tax worksheet 2021 for 2023. Figuring out the tax.

31 Qualified Dividends And Capital Gain Tax Worksheet Line 44 support

Web 2021 attachment 801 name(s) shown on return identifying number part i net minimum tax on exclusion items 1 combine lines 1 and 2e of your 2020 form 6251. 1 2 enter adjustments and preferences treated as exclusion items (see instructions). Web qualified dividends and capital gain tax worksheet: See the instructions for line 16 in the instructions to see.

Qualified Dividends And Capital Gain Tax Worksheet 2019 Pdf Ideas

Web 2021 attachment 801 name(s) shown on return identifying number part i net minimum tax on exclusion items 1 combine lines 1 and 2e of your 2020 form 6251. Ordinary income is everything else or taxable income minus qualified income. See the instructions for line 16 for details. Web this way, a small error will not cost a printed blank,.

Capital Gains Tax Worksheet —

Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. Web complete this worksheet only if line 18 or line 19 of schedule d is more than zero and lines 15 and 16 of schedule d are gains or if you file form 4952 and you have an amount on line 4g, even.

Qualified Dividends And Capital Gain Tax Worksheet For 2021 - There are three tax rates—0%, 15% and 20%—and they apply at different taxable income levels depending on your. Some of the worksheets displayed are lbi process unit, schedule d capital gains and losses, 40 of 117, dividents and capital gains information, qualified dividends and capital gains work, irs qualified dividends and capital gains work, irs publishes carried interest. Are you filing schedule d? See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. See the instructions for line 16 for details. Complete all necessary pages of form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns. Figuring out the tax on your qualified dividends can be. Web 2021 attachment 801 name(s) shown on return identifying number part i net minimum tax on exclusion items 1 combine lines 1 and 2e of your 2020 form 6251. Web the tax summary screen will indicate if the tax has been computed on the schedule d worksheet or the qualified dividends and capital gain tax worksheet.

Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns. See the instructions for line 16 for details. Figuring out the tax on your qualified dividends can be. Complete all necessary pages of form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Knowing how to download this form from the irs website can save precious time during tax season.

Estates and trusts, see instructions. Although many investors use schedule d to get the benefit of lower capital gains tax rates others can still use a worksheet in the tax instructions to skip. Enter the smaller of line 15 or 16 of schedule d. Complete all necessary pages of form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

Although Many Investors Use Schedule D To Get The Benefit Of Lower Capital Gains Tax Rates Others Can Still Use A Worksheet In The Tax Instructions To Skip.

What is the qualified dividend and capital gain tax worksheet? Web ‘qualified dividends and capital gain tax worksheet’ — a basic, simple excel spreadsheet for the math. (step by step) tax regardless of country and continent, all individuals must report their income and expenses to the relevant departments for tax purposes. Link to download excel spreadsheet below.

Web Taxes Are Taken Out On Both Capital Gains And Dividend Income But It’s Not The Same As Income Tax.

23 replies by anura guruge on february 24, 2022 for tax year 2022 filing in 2023 click to enlarge. There are three tax rates—0%, 15% and 20%—and they apply at different taxable income levels depending on your. Web qualified dividends and capital gain tax worksheet—line 11a keep for your records before you begin: • before completing this worksheet, complete form 1040 through line 15.

Ordinary Income Is Everything Else Or Taxable Income Minus Qualified Income.

Enter the smaller of line 15 or 16 of schedule d. Enter the amount of taxable qualified dividends and capital gain distributions on line 3b of form 1040. With dochub, you can easily complete your qualified dividends and capital gain tax worksheet 2021 for 2023. Web this worksheet allows taxpayers to accurately report their dividend and capital gains income on their tax returns.

Click Image To Download Clean, Very Simple Excel.

Web qualified dividends and capital gain tax worksheet (2022) • see form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer’s tax. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. In order to figure out how to calculate this tax, it’s best to use the qualified dividend and capital gain tax worksheet. Web 2021 attachment 801 name(s) shown on return identifying number part i net minimum tax on exclusion items 1 combine lines 1 and 2e of your 2020 form 6251.