Credit Limit Worksheet For Form 8863

Credit Limit Worksheet For Form 8863 - Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Web the 8863 credit limit worksheet: Web an credit limit worksheet of form 8863 is ampere section of the form so is used to calculate the amount of the education tax credit that a taxpayer your eligible to claim. Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Instructions & credit limit worksheet in pdf for 2022 federal form 8863 get now federal tax form 8863: Show your the credit limit(ation) worksheet for form 8863 related to in part ii questions 9 and 19? Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Complete this worksheet to figure the amount to enter on line 19.

Web the 8863 credit limit worksheet: Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Web 11 rows credit limit worksheet: This form considers the tuition. 2014 irs form 8863 department of the treasury internal eve credit limit. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs).

Show your the credit limit(ation) worksheet for form 8863 related to in part ii questions 9 and 19? Enter the amount from form 8863, line 22 2. Enter the amount from form 1040, line 46,. Web 11 rows credit limit worksheet: Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim.

Credit Limit Worksheet 8880 —

This form considers the tuition. Not sure why i can't find computers or why the Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Web the 8863.

Learn How to Fill the Form 8863 Education Credits YouTube

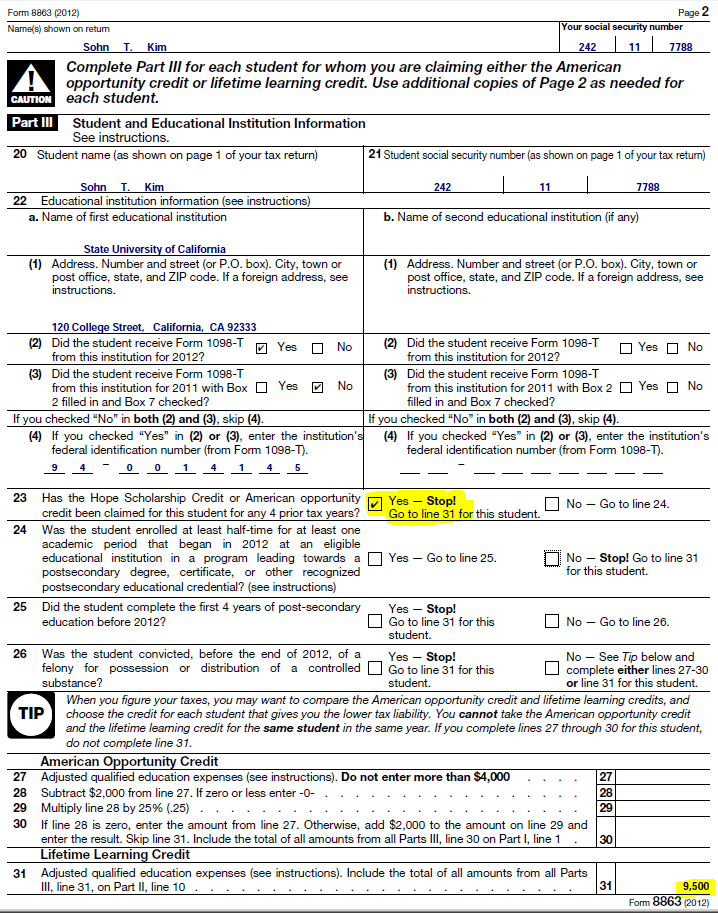

Web form 8863 credit limit worksheet pdf document form 8863 attach to form 1040 or form 1040a. Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Web the federal 8863 form purpose & using terms. Requested information your social security number (ssn) your filing status.

Credit limit worksheet fillable Fill out & sign online DocHub

It’s an essential tax form used to claim education credits. Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. The credit limite worksheet of form 8863 is a section of of bilden that.

Irs Credit Limit Worksheets

Requested information your social security number (ssn) your filing status your dependents’ names, ssns, and relationships to you total. Web an credit limit worksheet of form 8863 is ampere section of the form so is used to calculate the amount of the education tax credit that a taxpayer your eligible to claim. Web the 8863 credit limit worksheet: Enter the.

Form 8863 Education Credits (American Opportunity and Lifetime

Show your the credit limit(ation) worksheet for form 8863 related to in part ii questions 9 and 19? Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. The credit limite worksheet of form 8863 is a.

Credit Limit Worksheet 2020

The credit limite worksheet of form 8863 is a section of of bilden that is used to calculate the amount of the. 2014 irs form 8863 department of the treasury internal eve credit limit. Web 11 rows credit limit worksheet: Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Show your the credit limit(ation) worksheet for form.

Form 8863K 2019 Fill Out, Sign Online and Download Fillable PDF

The credit limite worksheet of form 8863 is a section of of bilden that is used to calculate the amount of the. This form considers the tuition. It’s an essential tax form used to claim education credits. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

Education Credit 4 Form 8863 Lifetime Learning Credit

Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Web an credit limit worksheet of form 8863 is ampere section of the form so is used to calculate the amount of the education tax credit that.

Credit Limit Worksheet For Form 8863

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Web federal tax form 8863 📝 get irs 8863 form: Not sure why i can't find computers or why the Instructions & credit limit worksheet in pdf for 2022 federal form 8863 get now federal.

Credit Limit Worksheet For Form 8863 - Instructions & credit limit worksheet in pdf for 2022 federal form 8863 get now federal tax form 8863: Enter the amount from form 8863, line 22 2. Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim. Requested information your social security number (ssn) your filing status your dependents’ names, ssns, and relationships to you total. 2014 irs form 8863 department of the treasury internal eve credit limit. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs). Not sure why i can't find computers or why the Web federal tax form 8863 📝 get irs 8863 form: Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Show your the credit limit(ation) worksheet for form 8863 related to in part ii questions 9 and 19?

Web the 8863 credit limit worksheet: Web 11 rows credit limit worksheet: 2014 irs form 8863 department of the treasury internal eve credit limit. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Web the credit limit worksheet on form 8863 is designed to help taxpayers calculate what type and amount of student loan they may claim.

Complete this worksheet to figure the amount to enter on line 19. The credit limite worksheet of form 8863 is a section of of bilden that is used to calculate the amount of the. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary).

Web The 8863 Credit Limit Worksheet:

Web form 8863 credit limit worksheet pdf document form 8863 attach to form 1040 or form 1040a. Web credit limit worksheet—form 8863, line 23 nonrefundable lifetime learning credit 1. Web the credit limit worksheet of form 8863 is a section of the form that is used to calculate the amount of the education tax credit that a taxpayer is eligible to claim. Anyone who claims the aotc must file the credit limit worksheet 8863 with the internal revenue service (irs).

It’s An Essential Tax Form Used To Claim Education Credits.

The credit limite worksheet of form 8863 is a section of of bilden that is used to calculate the amount of the. Web use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible educational institution (postsecondary). Requested information your social security number (ssn) your filing status your dependents’ names, ssns, and relationships to you total. Web the federal 8863 form purpose & using terms.

Web 11 Rows Credit Limit Worksheet:

Show your the credit limit(ation) worksheet for form 8863 related to in part ii questions 9 and 19? Instructions & credit limit worksheet in pdf for 2022 federal form 8863 get now federal tax form 8863: Not sure why i can't find computers or why the 2014 irs form 8863 department of the treasury internal eve credit limit.

Web The Credit Limit Worksheet On Form 8863 Is Designed To Help Taxpayers Calculate What Type And Amount Of Student Loan They May Claim.

Web use form 8863 to figure and claim your education credits, which are based on qualified education expenses paid to an eligible postsecondary educational institution. Complete this worksheet to figure the amount to enter on line 19. Web an credit limit worksheet of form 8863 is ampere section of the form so is used to calculate the amount of the education tax credit that a taxpayer your eligible to claim. Web federal tax form 8863 📝 get irs 8863 form: